Fed Watch

With the Fed cutting rates for the first time since the financial crisis, there are a lot of monetary policy moves to monitor. You can count on "Fed Watch" to bring you all the latest updates on the economic data shaping central bank policies.

-

00:41

00:41

Fed Holds Steady in December, Signals Three...

The FOMC unanimously voted to maintain its benchmark overnight borrowing rate, with members penciling in three cuts for the New Year.

-

02:32

02:32

Powell: Progress Will Be Bumpy

The Federal Reserve left rates unchanged for November, citing positive progress toward price stability.

-

04:47

04:47

Fed Vice Chair Notes Surge in Real Yields

Federal Reserve Vice Chair Philip Jefferson is clocking the movement in real yields, and says that tightening financial conditions will influence policy decisions in the future.

-

00:47

00:47

Chicago Fed Eyes Possibility of Goldilocks...

Chicago Federal Reserve Bank President Austan Goolsbee suggests that the so-called “golden path”--one in which the U.S. inflation rate cools without a recession–is not guaranteed, but within reach.

-

01:38

01:38

Fed’s Kashkari: U.S. Strength a ‘Surprise’

The U.S. economy has remained resilient despite the most aggressive rate hike cycle in forty years, a reaction that Federal Reserve Bank of Minneapolis chief Neel Kashkari described as surprising at a Town Hall in Minnesota earlier today.

-

01:45

01:45

Fed No Longer Forecasts Recession–Powell...

The Federal Reserve no longer foresees a recession according to Chairman Jerome Powell, but future rate hikes will be determined on a "meeting-by-meeting" basis. The announcement came after a much-anticipated rate hike that took benchmark borrowing costs to a twenty-two-year high.

-

02:22

02:22

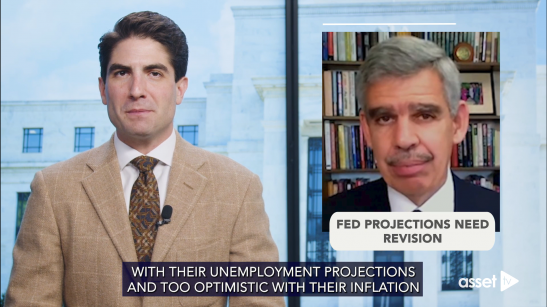

El-Erian Thinks Fed Projections Need Revision

Mohamed El-Erian criticizes the Federal Reserve's economic projections, arguing that they are overly pessimistic regarding unemployment and overly optimistic regarding inflation. El-Erian believes that the Fed will be compelled to revise downward their forecast of 4.5% unemployment by the year's end and revise upward their projection of 3.3% PCE inflation at the same time.

-

01:42

01:42

Fed Signals Further Hikes Possible

Federal Reserve Bank of San Francisco President, Mary Daly, became the latest regional Federal Reserve President to publicly state that future rate hikes are possible after the FOMC meeting in June.

-

01:15

01:15

Fed’s Fight With Inflation Not Over

T. Rowe Price’s Thomas Poullaouec commented on the Federal Reserve’s tenth consecutive rate hike, saying that while central banks are getting close to their terminal rates, tight labor markets are still putting upward pressure on inflation and it will take six to 18 months to see the full impacts of the hikes. In the meantime, Poullaouec expects Central banks to continue to focus on curbing...

-

01:01

01:01

Raymond James CIO Expects Mild Recession But...

Raymond James Chief Investment Officer Larry Adam is forecasting that the Fed will have to deal with a very mild recession. He tells Bloomberg how he sees the contraction playing out and why he says don’t expect rate cuts anytime soon.

-

01:08

01:08

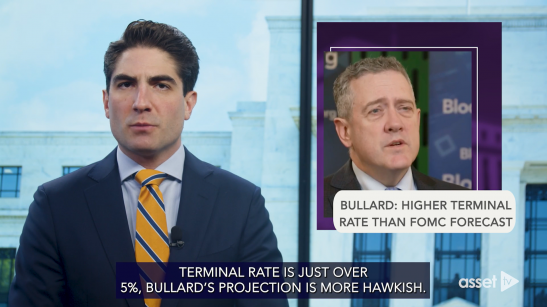

Fed’s Bullard Sees Inflation As More Sticky...

St. Louis’ Fed President, James Bullard, thinks inflation will be sticker than the Federal Open Market Committee are projecting. While the median range for Fed forecasted terminal rate is just over 5%, Bullard’s projection is more Hawkish.

-

01:40

01:40

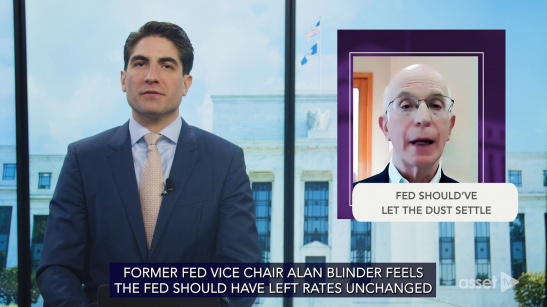

Former Fed Vice Chair Thinks Fed Should’ve...

Former Fed Vice Chair Alan Blinder feels the Fed should have left rates unchanged after their March FOMC meeting. The Fed elected to raise rates by 25 basis points, elevating the new rate range to 4.75%-5%, the highest since October 2007.

-

01:32

01:32

Powell’s Congressional Testimony Spooks...

After recent economic data showed an uptick in inflation, the Head of the Federal Reserve was forced to leave behind the “disinflationary” rhetoric used after the first Federal Open Market Committee Meeting of the year, instead describing inflation as “moderating” while testifying to Congress on the Federal Reserve’s Monetary Policy decisions.

-

01:25

01:25

St. Louis Federal Reserve President Vows Not...

They Say history repeats itself, but James Bullard, President of the Federal Reserve Bank of St. Louis said the Federal Reserve is determined not to let that happen. Or at least they want to avoid the inflation and volatility the US experienced in the 70’s.

-

01:46

01:46

Kansas City Fed President Says It’s Time To...

In a recent interview with Bloomberg, Kansas City Fed President, Esther George, said that the U.S. economy is in a good place and that the Fed’s efforts to curb inflation are working in many areas, but certain markets remain too tight.

-

01:42

01:42

September FOMC Brings Expected Rate Hike And...

While investors and expected and saw the Fed raise interest rates 75bps after the September FOMC meeting, Powell's rhetoric in his speech afterward kicked off a major market sell off.

-

01:32

01:32

Fed Battles Inflation with Another Historic...

The Fed is moving expeditiously toward neutral, raising interest rates another 75 basis points and matching June's hike, which was the most in three decades. During his press conference, Fed Chair Jay Powell told journalists that he does not think the U.S. is currently in a recession, but he warned that nothing works in the economy without price stability. Powell said the Fed could do another...

-

03:08

03:08

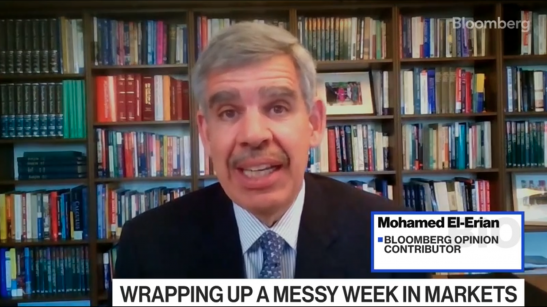

El-Erian Fears Fed Will Flip-Flop

Dr. Mohamed El-Erian, President of Queens' College, Cambridge and chief economic adviser at Allianz, is worried the Federal Reserve will flip-flop between policies as it strives to balance curbing inflation with maintaining a healthy economy.