Markets

Learn about the latest things going on in the Market.

-

01:33

01:33

PIMCO's Browne Sees 'Trifecta...

Erin Browne, PIMCO multi-asset strategies portfolio manager, tells Bloomberg TV why she is bullish on fixed income opportunities.

-

01:12

01:12

BMO’s Davis Expects Heightened Bond...

Earl Davis, Head of Fixed Income and Money Markets at BMO Global Asset Management, tells Bloomberg TV when and why he thinks the 10-year yield will retest both its 2023 highs and lows in 2024.

-

07:17

07:17

Looking Ahead to 2024

Jonathan Corpina, Senior Managing Partner of Meridian Equity Partners, reviews the year in markets and looks ahead to 2024 in the last episode of View from the Floor for the calendar year.

-

01:19

01:19

BNY Mellon CEO Vince on the One Lesson...

Bank of New York Mellon Corp. Chief Executive Officer Robin Vince tells Bloomberg TV how he is reflecting on everything that has transpired in markets this year.

-

00:42

00:42

Voya’s Reinhard Optimistic U.S. Will Avoid...

Barbara Reinhard, Voya CIO and Head of Asset Allocation, tells Bloomberg TV that the U.S. economy will likely make it through 2024 without a recession.

-

09:59

09:59

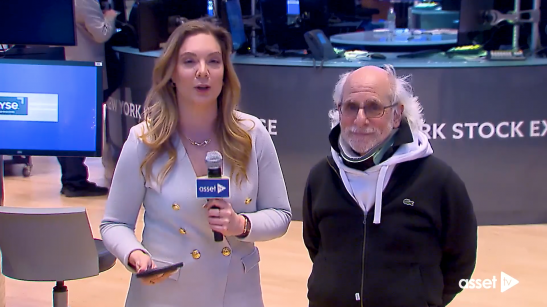

Einstein of Wall Street Reacts to Fed Pivot

TradeMas Senior Floor Trader Peter Tuchman discusses the results of the latest FOMC Meeting in December and his market outlook for 2024 with Gillian Kemmerer.

-

01:13

01:13

Oppenheimer’s Stoltzfus Makes Bullish 2024...

John Stoltzfus, chief investment strategist at Oppenheimer Asset Management, tells Bloomberg TV his expectations for monetary policy and equities in the year ahead.

-

00:55

00:55

Columbia Threadneedle’s Al-Hussainy Shares...

Ed Al-Hussainy, global rates strategist at Columbia Threadneedle, shares his outlook for monetary policy in 2024 on Bloomberg Television.

-

02:48

02:48

State Street: Merry Christmas from The Fed

The risk-on rally resulting from the Fed’s dovish pivot was an early Christmas present, according to State Street Senior Multi Asset Strategist Ben Luk.

-

01:58

01:58

Julius Baer: ECB First Mover?

Of the Central Banks preparing to pivot, Europe will be the first to cut rates according to Mark Matthews, Head of Asia Research at Julius Baer.

-

02:30

02:30

Citi's Bailin: "Slow Then Grow...

Citi Global Wealth CIO and Head of Investments David Bailin foresees a 15-20% total return on balanced portfolios moving into 2025.

-

01:21

01:21

Horizon Investments’ Ladner: Fed Will Need...

Scott Ladner, Head of Investment Management at Horizon Investments, shares his outlook for interest rates on Bloomberg TV and when he expects the Fed to start cutting.

-

01:23

01:23

Sonders Talks ‘Rolling Recessions’

Charles Schwab Chief Investment Strategist Liz Ann Sonders makes the case for rolling recessions as opposed to the black-and-white narrative of a hard or soft landing on Bloomberg Daybreak: Australia.

-

01:46

01:46

Morgan Stanley Private Wealth’s Simonetti...

“We’re going nowhere, but we are getting there fast,” Morgan Stanley Private Wealth Management Senior Vice President Katerina Simonetti tells Bloomberg TV. She shares her outlook heading into 2024.

-

06:25

06:25

From Goldilocks to Santa Claus

NYSE Senior Market Strategist Michael Reinking joins Gillian Kemmerer on the floor to discuss his outlook for yearend--from the resurgent soft landing narrative to the ‘good is bad, bad is good’ market reaction to economic data.

-

00:50

00:50

Global X Expands $19 Billion Income Suite

Global X announced the debut of the Global X MSCI Emerging Markets Covered Call ETF (EMCC). We share more details about the launch.

-

00:47

00:47

Allspring’s Patel Thinks Handful of Stocks...

Margie Patel, senior portfolio manager at Allspring Global Investments, tells Bloomberg TV that income-oriented investors can still own big tech. She explains why that could matter in 2024.

-

01:26

01:26

Envestnet: Don’t Bet on a Stuck Landing

Envestnet Chief Investment Officer Dana D’Auria joins Bloomberg Daybreak to discuss the whiplash in markets regarding a goldilocks scenario.