Markets

Learn about the latest things going on in the Market.

-

07:17

07:17

Looking Ahead to 2024

Jonathan Corpina, Senior Managing Partner of Meridian Equity Partners, reviews the year in markets and looks ahead to 2024 in the last episode of View from the Floor for the calendar year.

-

09:59

09:59

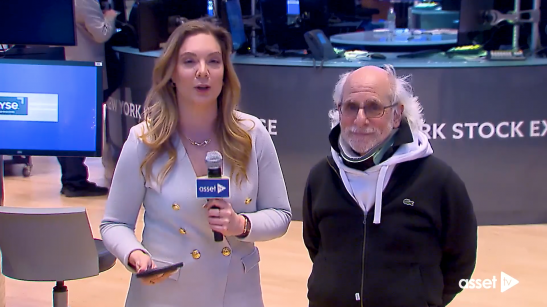

Einstein of Wall Street Reacts to Fed Pivot

TradeMas Senior Floor Trader Peter Tuchman discusses the results of the latest FOMC Meeting in December and his market outlook for 2024 with Gillian Kemmerer.

-

06:25

06:25

From Goldilocks to Santa Claus

NYSE Senior Market Strategist Michael Reinking joins Gillian Kemmerer on the floor to discuss his outlook for yearend--from the resurgent soft landing narrative to the ‘good is bad, bad is good’ market reaction to economic data.

-

00:50

00:50

Global X Expands $19 Billion Income Suite

Global X announced the debut of the Global X MSCI Emerging Markets Covered Call ETF (EMCC). We share more details about the launch.

-

04:38

04:38

A Trader's Journey at the NYSE

Embark on a captivating journey through the New York Stock Exchange as Maya Raytsen, a young floor trader at Quattro Securities, shares her remarkable experiences. Delve into the evolution of trading amidst technological advancements, challenges faced, and the rich history of the iconic NYSE.

-

27:08

27:08

2023 Economic Outlook: Q3 Update

Investors preparing for a historically unlikely “soft landing” may want to consider different scenarios amid increasing risks. PIMCO shares their latest global economic outlook across regions and markets and what it all means for investors. Discover how PIMCO fixed income can lead to better outcomes. For CE credit from the CFP Board, please watch the video and read this white paper. Once...

-

09:42

09:42

The Case for Private Markets

In this episode of View From The Floor, Blue Owl (NYSE: OWL) President of Global Private Wealth Sean Connor discusses the opportunity set in private markets, the role of alternatives in a portfolio and highlights Blue Owl’s current areas of focus.

-

05:58

05:58

Earnings Season & FOMC Look Ahead

Meridian Equity Partners Senior Managing Partner Jonathan Corpina joins Gillian Kemmerer on the floor of NYSE as earnings season heats up. He recaps what we have seen so far from Q3, the surge in real yields and much more.

-

05:11

05:11

Geopolitics, Real Yields & Macro Data

Wellington Shields Vice President Joseph Dente joins Gillian Kemmerer to discuss the action-packed week in global markets--from the surge in real yields and blockbuster jobs report to the war in Israel and its implications for investors.

-

06:56

06:56

September FOMC Recap

In this episode of View From the Floor, NYSE Senior Market Strategist Michael Reinking unpacks the latest FOMC meeting--from Fed Chair Jerome Powell's comments on a soft landing scenario to the implications for long term rates.

-

08:24

08:24

August CPI Hotter Than Expected

TJM Investments Managing Director Timothy Anderson reacts to the August CPI print which showed accelerated inflation--largely fueled by an uptick in energy prices. He also looks ahead to August retail figures and the Arm IPO later this week.

-

10:45

10:45

Peter Tuchman Talks Structural Shifts in the...

In the latest episode of View From The Floor, Peter Tuchman, Senior Floor Trader at Trade Mas, joins Gillian Kemmerer to discuss where we are in the current rate cycle, the pitfalls of tired data in the new economy and more.

-

16:30

16:30

A Tale of Two Tapes

Stonebriar Wealth Management President Joe Davis joins Asset TV on the floor of the New York Stock Exchange to unpack both the bull and bear case for the U.S. economy.

-

08:06

08:06

Mercer Global Investment Chief Talks Jackson...

Mercer Global Chief Investment Strategist Rich Nuzum joins Gillian Kemmerer on the floor of the New York Stock Exchange ahead of the NVIDIA earnings release to discuss big tech's role in the equity bull market, the upcoming Jackson Hole Symposium, rising yields on the 10-year U.S. Treasury and his outlook for China.

-

06:17

06:17

Envestnet Market Outlook

Envestnet Co-CIO and Group President for Solutions Dana D'Auria joins View from the Floor to discuss the current climate, investment trends to watch and more.

-

06:20

06:20

NYSE’s Reinking Talks Market Mega-Week

In this episode of View from the Floor, NYSE Senior Market Strategist Michael Reinking breaks down the busiest week of the summer for equities markets. From the Bank of Japan’s curveball to the Federal Reserve’s well-telegraphed rate hike, Reinking shares his takeaways with Gillian Kemmerer from the floor of the New York Stock Exchange.

-

13:21

13:21

Feeling Bearish? How To Prepare

David Stryzewski, CSA, NSSA, CEO of “Sound Planning Group” is feeling bearish and shares what he's talking about with his clients and other advisors, how he’s adjusting his allocations, and where he still sees ample opportunity.

-

01:43

01:43

Columbia Emerging Markets Fund

Discover how a consistent approach to emerging markets investing may help you capitalize on one of the biggest potential growth opportunities in today's market.