Latest

-

05:56

05:56

The ETF Show - Absolute Return Strategies

Christopher Day, Founder and CEO of Days Global Advisors, shares how the DGA Absolute Return ETF works, whether it should be considered an alternative or core allocation, what the returns have been like for clients, and more.

-

01:33

01:33

PIMCO's Browne Sees 'Trifecta...

Erin Browne, PIMCO multi-asset strategies portfolio manager, tells Bloomberg TV why she is bullish on fixed income opportunities.

-

08:38

08:38

Meet the RIA: Ballentine Partners

Drew McMorrow, MBA, CFP®, President and CEO of Ballentine Partners, shares more about the firm’s journey to becoming a Barron's top 100 RIA over the past four decades. He explains the firm’s tagline, “A Decidedly Human Approach to Managing Wealth,” and what he thinks families should be focused on right now to make smart decisions about their wealth.

-

01:12

01:12

BMO’s Davis Expects Heightened Bond...

Earl Davis, Head of Fixed Income and Money Markets at BMO Global Asset Management, tells Bloomberg TV when and why he thinks the 10-year yield will retest both its 2023 highs and lows in 2024.

-

05:25

05:25

Meet the RIA: Evan’s May Wealth

Brooke May, Managing Partner at Evans May Wealth, shares the RIA's evolution, equity-focused approach, and commitment to comprehensive financial services. Discover their unique perspective in the financial landscape and the importance of a long-term investment view.

-

07:17

07:17

Looking Ahead to 2024

Jonathan Corpina, Senior Managing Partner of Meridian Equity Partners, reviews the year in markets and looks ahead to 2024 in the last episode of View from the Floor for the calendar year.

-

01:19

01:19

BNY Mellon CEO Vince on the One Lesson...

Bank of New York Mellon Corp. Chief Executive Officer Robin Vince tells Bloomberg TV how he is reflecting on everything that has transpired in markets this year.

-

00:42

00:42

Voya’s Reinhard Optimistic U.S. Will Avoid...

Barbara Reinhard, Voya CIO and Head of Asset Allocation, tells Bloomberg TV that the U.S. economy will likely make it through 2024 without a recession.

-

05:04

05:04

The ETF Show: Concentration & Market...

MSCI’s Mark Carver dives into what ETF flows have been telling us and some continued trends to watch as we head into the new year.

-

09:59

09:59

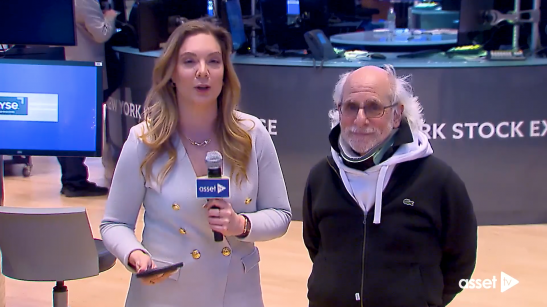

Einstein of Wall Street Reacts to Fed Pivot

TradeMas Senior Floor Trader Peter Tuchman discusses the results of the latest FOMC Meeting in December and his market outlook for 2024 with Gillian Kemmerer.

-

01:13

01:13

Oppenheimer’s Stoltzfus Makes Bullish 2024...

John Stoltzfus, chief investment strategist at Oppenheimer Asset Management, tells Bloomberg TV his expectations for monetary policy and equities in the year ahead.

-

00:48

00:48

BlackRock Launches Active ETF Following...

BlackRock is bringing its total return strategy managed by Rick Rieder, CIO of Global Fixed Income, to ETF Investors. We share more details about the debut of Rieder’s second active ETF.

-

00:55

00:55

Columbia Threadneedle’s Al-Hussainy Shares...

Ed Al-Hussainy, global rates strategist at Columbia Threadneedle, shares his outlook for monetary policy in 2024 on Bloomberg Television.

-

02:48

02:48

State Street: Merry Christmas from The Fed

The risk-on rally resulting from the Fed’s dovish pivot was an early Christmas present, according to State Street Senior Multi Asset Strategist Ben Luk.

-

00:41

00:41

Fed Holds Steady in December, Signals Three...

The FOMC unanimously voted to maintain its benchmark overnight borrowing rate, with members penciling in three cuts for the New Year.

-

01:58

01:58

Julius Baer: ECB First Mover?

Of the Central Banks preparing to pivot, Europe will be the first to cut rates according to Mark Matthews, Head of Asia Research at Julius Baer.

-

02:30

02:30

Citi's Bailin: "Slow Then Grow...

Citi Global Wealth CIO and Head of Investments David Bailin foresees a 15-20% total return on balanced portfolios moving into 2025.

-

00:50

00:50

Fidelity Launches Six New Active ETF...

Fidelity Investments launched a new suite of ETFs: The Fidelity Enhanced Large Cap Core ETF (FELC); Fidelity Enhanced Large Cap Growth ETF (FELG); Fidelity Enhanced Large Cap Value ETF (FELV); Fidelity Enhanced Mid Cap ETF (FMDE); Fidelity Enhanced Small Cap ETF (FESM); and Fidelity Enhanced International ETF (FENI).