Latest

-

17:06

17:06

Regulation Changes To Inherited IRAs

Erika Safran, CFP ® Principal at Safran Wealth Advisors, discusses the changes to inherited IRA accounts that came with the passing of the Secure and Secure 2.0 Acts and what they mean for account beneficiaries.

-

01:08

01:08

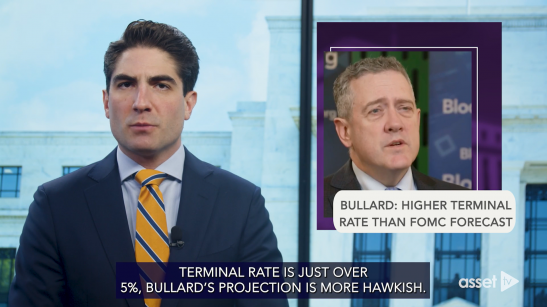

Fed’s Bullard Sees Inflation As More Sticky...

St. Louis’ Fed President, James Bullard, thinks inflation will be sticker than the Federal Open Market Committee are projecting. While the median range for Fed forecasted terminal rate is just over 5%, Bullard’s projection is more Hawkish.

-

05:19

05:19

The ETF Show - Option & Muni Bond Income...

Jay Pestrichelli, CEO of ZEGA Financial, discusses the launch of their two single-stock, option income strategy ETFs, TSLY and OARK. And Goldman Sachs Asset Management Portfolio Manager, Alexa Gordon, introduces the newly launched, tax free income strategy, GS Community Municipal Bond ETF (GMUN).

-

01:40

01:40

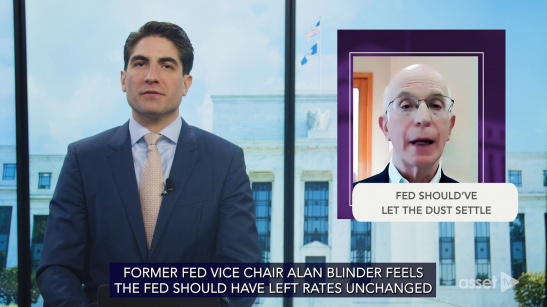

Former Fed Vice Chair Thinks Fed Should’ve...

Former Fed Vice Chair Alan Blinder feels the Fed should have left rates unchanged after their March FOMC meeting. The Fed elected to raise rates by 25 basis points, elevating the new rate range to 4.75%-5%, the highest since October 2007.

-

13:59

13:59

Engaging and Empowering Women Through...

Carey Shuffman, Executive Director and Head of The Women's Segment at UBS, discusses the research done by UBS over several years, looking at how involved women are in their financial planning, the importance of involvement, how women can take greater control of their financial planning, and ways Advisors can help.

-

01:32

01:32

Powell’s Congressional Testimony Spooks...

After recent economic data showed an uptick in inflation, the Head of the Federal Reserve was forced to leave behind the “disinflationary” rhetoric used after the first Federal Open Market Committee Meeting of the year, instead describing inflation as “moderating” while testifying to Congress on the Federal Reserve’s Monetary Policy decisions.